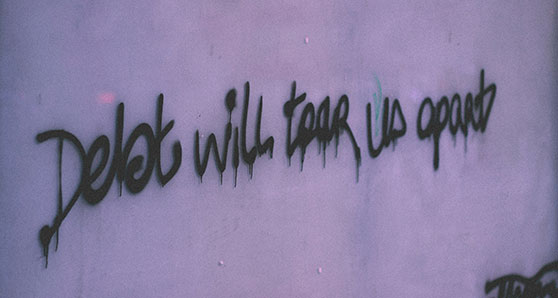

Cities in Alberta continue to lead the country with average consumer debt levels.

A report released on Tuesday by Equifax found that Fort McMurray had average debt (excluding mortgages) of $39,466 in the second quarter of this year, up 1.3 per cent from a year ago.

Calgary saw a year-over-year hike of 0.4 per cent to $29,981 in average debt while Edmonton debt rose by 1.4 per cent to $28,787.

Alberta led all provinces with average debt of $29,390 in the first quarter of the year, up 0.9 per cent from last year.

The Equifax report found delinquency rates are on the rise, jumping to 1.3 per cent in Calgary. That was a hike of 11.3 per cent year over year.

In Edmonton, delinquencies rose by 4.4 per cent from a year ago to 1.49 per cent.

In Fort McMurray, delinquencies increased by 3.6 per cent year over year to 1.75 per cent.

Overall in Alberta, the delinquency rate jumped 7.9 per cent to 1.43 per cent.

Across Canada, in the first quarter, the average debt, excluding mortgages, was $23,745, which was up two per cent year over year, and the delinquency rate rose by 5.8 per cent to 1.12 per cent.

“It looks like, after turning to credit to clear their winter blues, consumers were able to get back on a more reasonable track through the spring,” said Bill Johnston, vice-president of data and analytics at Equifax Canada, in a news release.

“There were some troubling signs in the first quarter, with credit card usage and average debt rising sharply for some vulnerable consumer groups. The results in the last quarter are much more aligned to the current economic situation.

“The delinquency trend is rising but the magnitude has been muted by the sharp jump in bankruptcies. Traditionally, the trends in delinquency and bankruptcy have been highly connected. That has completely broken down since mid-2018, with bankruptcy outpacing delinquency significantly.

“The current holding pattern at the Bank of Canada provides consumers with an opportunity to balance their financial situation. It can help keep delinquency rate increases in check.

“The concern, particularly if rates are cut, is that consumers could overextend themselves further. Any rate cuts are likely short term. Locking into low fixed rates and avoiding overusing credit cards is a prudent strategy to follow if rates drop.”

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.