Tim Hortons is going where the growth is: China.

Tim Hortons is going where the growth is: China.

The Canadian institution announced it will expand its portfolio of 4,700 restaurants by signing a joint venture partnership with a Chinese-based equity firm.

Tim Hortons has locations in the United States, the Arab Emirates, the Philippines and the United Kingdom. And it intends to open 1,500 new restaurants in China in the next decade. By 2028, almost a quarter of Tim Hortons restaurants will be in China.

Cartesian Capital, the equity firm partnering with Tim Hortons, worked with Timmy’s parent company, Restaurant Brands International (RBI), in an expansion of the Burger King franchise into China more than a decade ago. Burger King now has more than 1,000 restaurants in China.

Over the years, the Chinese-Canadian community has embraced Timmy’s menu, which is a result of their familiarity with its place in the country’s culture.

In China, the majority of the population may only vaguely understand the appeal of hockey, never mind the allure of Timbits and Salted Caramel Iced Capps. Burger King has been successful thanks to the directness of its name. It will be interesting to see what kind of brand and menu adjustments RBI will make as it works to adapt the namesake of a legendary National Hockey League defenceman to the Chinese market, without betraying Timmy’s deep Canadian roots.

Starbucks has already infiltrated the Chinese market, boasting more than 2,800 locations. Thanks to the Starbucks effect, the demand for coffee in China is up more than 15 per cent.

In Canada, growth is minimal, even though more than 71 per cent of Canadians over the age of 18 drink café daily, compared to 67 per cent who regularly drink water.

Coffee is much trendier in China, as the country prospers from rapid urbanization, a growing middle class and rising incomes. Once the republic’s favourite drink, tea is slowly giving way to its roasted rival. While coffee is increasingly consumed outside the home, tea remains a traditional, domestic favourite.

Tim Hortons’ legacy in Canada lies in convincing Canadians to consume coffee somewhere other than at home. However, in these past few years an increasing number of Caucasian Canadians are preparing coffee themselves. The trend for Asian Canadians is the opposite. For marketers, this shift represents the golden goose. RBI understands that once a certain level of wealth is achieved and disposable income increases, coffee-related behaviours will change.

To grow the chain in China, RBI must accept that the benchmark for success is Starbucks. After 50 years of business and community building, Tim Hortons became the benchmark in Canada. The advantage Tim Hortons has over Starbucks in China is its middle-of-the-road approach to coffee. To convince someone who traditionally drinks simple tea to switch to a decadent Starbucks Frappuccino presents a significant challenge. Tim Hortons can slip in between current Chinese habits and the representation of an idealistic western way of life. Its menu will need be tweaked, of course – potatoes wedges and steak wraps will likely not be crowd pleasers, at least initially.

Tim Hortons’ move to China is clearly a natural for a chain searching for a new identity in new territories. With deep roots in Canada and an American flair to its management, Timmy’s could emerge as a global coffee player in the next decade.

Its status as a cultural icon in the Canadian market was well established before RBI’s purchase of the chain in 2014.

While Canada is mainly known for its homegrown commodities such as canola and maple syrup, Tim Hortons’ entrée into China could bring Canadian culture into an entirely new and bourgeoning market. Success could reap dividends for many other sectors as well, especially in China. It also gives international exposure to our cultural values, beliefs and way of life.

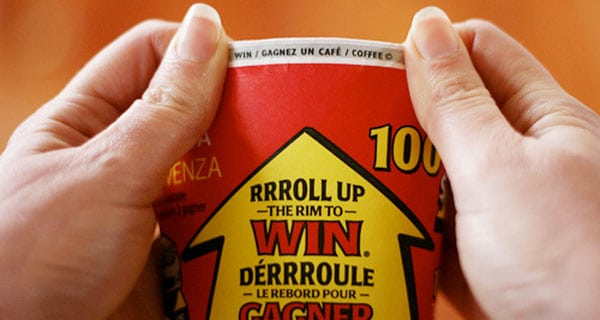

Timmy’s may have to create promotions other than Roll Up the Rim to Win. Mandarin- or Cantonese-speaking customers may find such a tongue-twisting slogan difficult. But perhaps the taste of a double-double will ease the transition.

Dr. Sylvain Charlebois is senior director of the agri-food analytics lab and a professor in food distribution and policy at Dalhousie University.

Sylvain is a Troy Media Thought Leader. Why aren’t you?

For interview requests, click here. You must be a Troy Media Marketplace media subscriber to access our Sourcebook.

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.