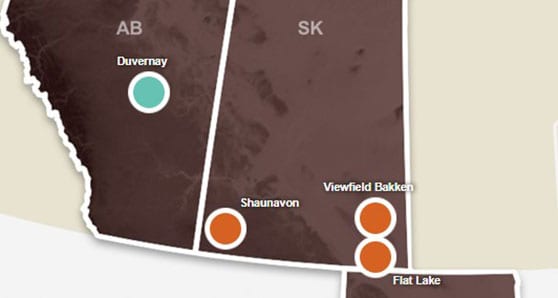

Crescent Point Energy announced Tuesday it was selling its Uinta Basin asset in its entirety and certain southeast Saskatchewan conventional assets for $912 million.

Crescent Point Energy announced Tuesday it was selling its Uinta Basin asset in its entirety and certain southeast Saskatchewan conventional assets for $912 million.

The company said its net debt is expected to improve to approximately $2.75 billion at year-end 2019, down from $4.40 billion prior to the changes in senior management in 2018.

“Since we established our transition plan in September 2018, we have meaningfully improved the sustainability of our business model by revising our capital allocation process, lowering our cost structure and strengthening our balance sheet,” said Craig Bryksa, President and CEO of Crescent Point, in a news release.

“The sale of the Uinta Basin and certain conventional assets is accretive for our shareholders and aligned with the key criteria we established for our asset portfolio. These transactions are a considerable step forward in our ongoing plan to focus our asset base.”

It was not announced who was purchasing the assets.

Crescent Point said it expects to generate improved corporate returns and a stronger operating netback from lower royalties and reduced expenses as a result of this disposition. The capital expenditures required to sustain the Company’s annual production are also expected to improve due to a shallowing of the corporate decline rate, it added.

The sale is expected to be completed in October, subject to the satisfaction of normal closing conditions and the receipt of regulatory approvals.

“In September 2018, new management established a transition plan centered on its key value drivers of disciplined capital allocation, cost efficiencies and balance sheet improvement. The Company has successfully shifted its corporate strategy and capital allocation process, realigned its focus on generating stronger returns, realized cost improvements throughout the organization and materially enhanced its financial flexibility,” said the company.

“Including today’s announcement, Crescent Point has now executed a total of over $1.3 billion in asset dispositions since the change in senior management and approximately $975 million of asset dispositions in 2019 alone. The Company continues to pursue additional asset sales, including the balance of its southeast Saskatchewan conventional assets, and the monetization of its Saskatchewan gas infrastructure assets, the process for which continues to progress. The Company will remain disciplined and flexible as it seeks to create additional value for its shareholders.”

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.