By Mark Milke

and Lennie Kaplan

Canadian Energy Centre

Humans are wired to respond to stories that paint a relatable picture of an issue at hand. And those stories are easier to remember.

If we repeat a Rex Murphy story about how out-of-work cod fishery workers from Newfoundland saved their homes and marriages by moving to Alberta’s oil sands, you may remember it years from now.

Murphy told a crowd last year how, after the 1992 moratorium on the cod fishery was imposed, 30,000 Newfoundlanders went West to work in the oil patch. Those are a lot of marriages and families.

Mark Milke

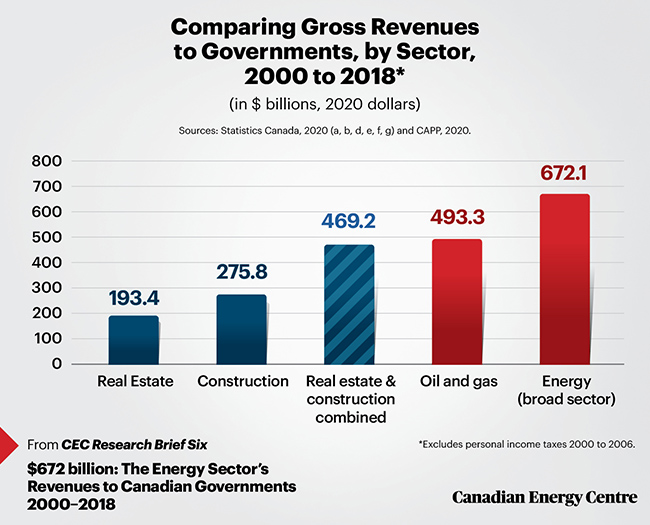

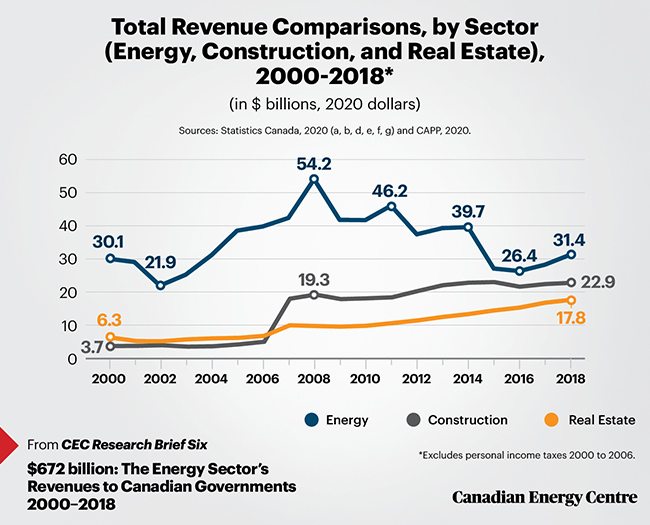

Between 2000 and 2018 (adjusted for inflation to 2020 dollars), Canada’s energy sector paid $672 billion to federal, provincial and municipal governments in taxes. The oil and gas sector (a subset of the energy sector) was responsible for nearly three-quarters of that, over $493 billion in taxes and royalties paid to Canada’s governments.

That $493 billion includes $14 billion in indirect taxes (sales taxes like the GST); $45 billion in lease payments for the use of Crown land; $60 billion in corporate income taxes; $68 billion in personal income taxes; and a whopping $306 billion in rents and royalties.

That $493 billion from the oil and gas sector is $18 billion more than the $475 billion the federal government spent on family allowance and other children’s benefits between 1970 and 2019.

What did other sectors pay to governments between 2000 and 2018?

- Real estate: just over $193 billion.

- Construction: about $276 billion.

Lennie Kaplan

The real estate and construction sectors’ combined $469 billion in revenues is still $24 billion less than the $493 billion paid to governments by the oil and gas sector.

We’re often asked how the revenue from the oil and gas industry compares to an industry like manufacturing. But it can’t be compared because the Statistics Canada data for manufacturing includes oil and gas manufacturing. Construction and real estate are completely separate revenue streams. That’s why we can compare their taxes paid with the oil and gas industry.

Some will argue that the $493 billion from oil and natural gas reflects the past and not the future, that they’re ‘sunset’ industries.

But energy transitions are notoriously difficult to predict.

University of Manitoba professor of energy and environment (emeritus) Vaclav Smil – who likes the idea of less carbon emissions but is also a world expert in energy transitions – pointed out the following in his recent paper for the University of Saskatchewan’s Johnson Shoyama Graduate School of Public Policy (note to U.S. president-elect Joe Biden): “Designing hypothetical roadmaps outlining complete elimination of fossil carbon from the global energy supply by 2050 is nothing but an exercise in wishful thinking that ignores fundamental physical realities.”

The Organization of Petroleum Exporting Countries (OPEC) forecasts that the world will consume 109 million barrels daily in 2045. That’s up from 91.7 million barrels daily now forecast for 2020 by the International Energy Agency.

And expect natural gas demand to rise in the short- and long-term (30 per cent higher by 2040). That’s in part because of population and economic growth in Asia, and because of power plants that switch from coal-fired electricity to natural gas. (The latter is cleaner on particulate emissions and emits less carbon relative to coal.)

If Smil is correct that energy transitions can’t ignore “fundamental physical realities” and oil and natural gas will be with us for some time – decades at least – then the only question is if the public and politicians think they can do without nearly half a trillion dollars in future oil and gas revenue, any more than they could have sacrificed nearly $500 billion in the last two decades.

That $493 billion in oil and gas taxes paid for a lot of school lunches, kids’ clothes, runners, after-school lessons and much else.

But as big as such numbers are, they represent something beyond even children’s lunches. To quote Murphy, “Employment is not just a damn paycheque. It is the spine of most people’s existence.”

That spine of existence is what $493 billion in taxes from oil and gas directly represents.

Mark Milke and Lennie Kaplan are with the Canadian Energy Centre, an Alberta government corporation funded in part by taxes paid by industry on carbon emissions. They are authors of $672 billion: The Energy Sector’s Revenues to Canadian Governments 2000-2018.

Mark and Lennie are Troy Media Thought Leaders. Why aren’t you?

For interview requests, click here. You must be a Troy Media Marketplace media subscriber to access our Sourcebook.

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.